How much would you invest in such a fund? The answer clearly depends on how much everyone else is going to invest. Can you trust your co-investors to put in at least as much as you do?

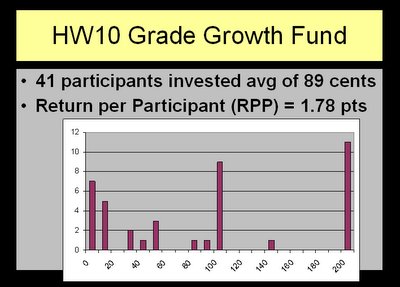

A few weeks ago I invited my students to participate in this experiment by investing their hard-earned grade points in exactly such a fund, as a homework exercise (HW10, to be exact). To protect against individual ruin, I limited the maximum investment to 2 points out of 150 earned over the course of the semester. By requesting deposits in "cents" (0.01 of a point), I gave students a range of 0-200 to choose from.

Here are the results. You can see that many students chose to invest 200 cents (the maximum allowed) but there were enough free-riders in the fund so that even after doubling, the fund returned less than 200 cents to each investor.

In other words, many students lost 0.22 points by investing in the fund.

In other words, many students lost 0.22 points by investing in the fund.Claire Reinelt alerted me yesterday to German researchers B. Rockenbach and M. Milinski, who did a very similar study and got their results published in Nature just this week. Their study also allowed fund investors to dedicate a portion of their deposit to punishing free-riders on the fund. This option turns out to be a critical ingredient to designing a fund with maximal collective gain. See also this cute Boston Globe article on the study: "Want cooperation? Carrots and sticks get the best results."

This work is licensed under a Creative Commons Attribution-ShareAlike 2.5 License and is copyrighted (c) 2006 by Connective Associates except where otherwise noted.

1 comment:

Bruce - Absolutely. And the other key thing is who gets wield the sticks and proffer the carrots - the participants themselves...

Post a Comment